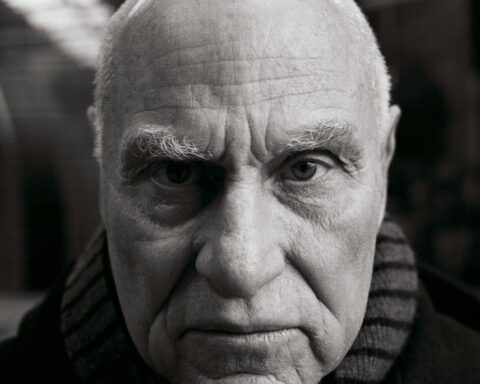

As the policy chairman of the City of London, Chris Hayward has been living through challenging times. He talked to us about Brexit and the future of the city. Interview.

Has Brexit provoked a big change in the relationship between London and Luxembourg?

We’ve always had a very special relationship between our two countries as important financial centres. Before Brexit, we worked very closely with Luxembourg, and we’ll continue to do so. In the aftermath of the Brexit vote, I feared a mass exodus of jobs from the UK into Europe, but just 7000 jobs went out of 2.3 million in the UK financial services sector, and now things are settling down. We’ve passed the Windsor framework, which allows the EU and the UK to start talking and trading with each other again, and we’ve got our financial services and markets bill going through Parliament, which will redesign our regulatory system. So while we face challenges, London is competitive, it’s still a big global player, and so we’ll end up maintaining a strong relationship with Luxembourg, within a new framework.

“It’s a huge challenge for us to maintain the number one slot in the world but we intend to do just that.” – Chris Hayward, City of London

As financial technology develops, are there any particular challenges that you think London is well placed to address?

Outside of the US, the UK is the fastest growing country for fintech businesses, so we have a huge opportunity. But while we’re great at startups, we’re not so good at scale ups. The challenge is to keep these FinTech businesses on the London Stock Exchange, rather than going on the NASDAQ in America. We’ve had some success there, because we’ve had some unicorns, and we’re very proud of that, but we need more, because the future of financial services is all about the digital economy. The way in which we used to go into high street banks will be a thing of the past, so this is a very exciting part of financial services to be engaged in. For example, the UK government is now consulting on cryptocurrencies, to make sure that the regulation is proportionate in protecting customers. They’re a very exciting development, part of our fintech future.

What are your hopes and expectation for London in the future?

It’s a huge challenge for us to maintain the number one slot in the world, but we intend to do just that. London has so many natural advantages: our rule of law, our language, our time zone. One of the things I’m doing to make sure that we maintain our position is to chair a piece of work around finance for growth. We’ve had sluggish growth for the past 15 years, and whoever’s in power at the next general election, we know that the only agenda can be economic growth, so we want to shape that. We want to see growth back in the economy and the financial services sector. Just the businesses in the city, the square mile of London, contributes 13% of the government’s tax base, so we have a wonderful chance to influence the government on getting growth back into our economy.