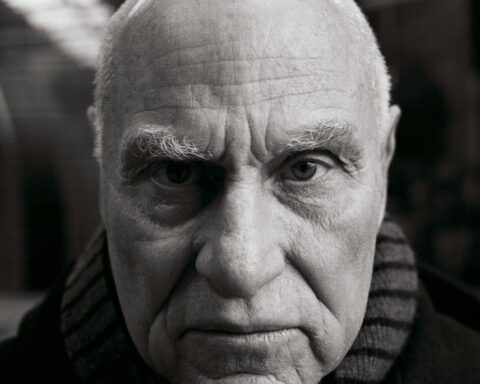

ABBL: The Rallying Flag for Luxembourg Banking

Jerry Grbic, the ABBL’s CEO, outlines his vision for maintaining regulated, innovative, and responsible banking services in Luxembourg in an environment of healthy competition that brings continued benefits to all in the Duchy. He calls on the new government to proactively promote Luxembourg’s interests on regulatory matters in international forums.

Can you explain what the Association des Banques et Banquiers Luxembourg (ABBL) is?

The ABBL represents Luxembourg’s banking sector. But we don’t only represent banks, our 270 member or associate companies and 2,500 financial sector members also include investment, payment, and e-money companies, fintechs, and their advisers. The ABBL promotes regulation because a clear and transparent regulatory framework is the prerequisite for stakeholders in the financial system to work together in trust. Innovation helps meet customers’ changing needs, improves operational efficiency, and enhances security. Our responsibility is threefold: towards the savers who entrust us with their assets, towards the private and corporate customers whose projects we help finance, and towards the planet, because banks play a decisive role in the sustainable and digital transition of our economies.

How do you see the future of the Luxembourg financial sector?

The Luxembourg banking ecosystem that we have developed over the last 40 years is unique in terms of skills and its openness to the world. It is highly diversified comprising in almost equal parts of retail banks, private banks, corporate banking, and custodian banks. The stability and resilience of Luxembourg continues to attract foreign players as their gateway to the European market. Nevertheless, all our members face the same challenge of competitiveness. Banks must remain competitive so as to provide the foundation for the future of Luxembourg as a financial center and the country’s prosperity.

“The banking ecosystem that we have developed over the last 40 years is unique in terms of skills and openness to the world”

What measures should the government put in place to maintain the competitiveness of the banking sector?

The new government is aware of the contribution banking makes to the Luxembourg community through the taxes it pays and its financing of projects. The coalition agreement says it wants to strengthen financial sector competitiveness. We welcome the government’s intention to bring the taxation into line with the EU/OECD average. We would also like to see a simple, transparent, and rapid transposition of the new reliefs for digital and green investments decided during the previous legislature. The new government seems to be open to measures to alleviate the housing shortage and other measures to attract and retain talent. We are also calling on the government to actively lobby on regulatory issues in institutions like the Commission and the European Parliament and bodies such as the OECD, the FATF, and the World Economic Forum.