The world’s biggest investor, Blackrock, bided its time: Blowing hot and cold over the relevance of cryptocurrencies. It watched from the sidelines as the market matured from a narrow interest among “amateur” enthusiasts and crooks. Now, the launch of its well-received cryptocurrency exchange-traded funds has created a new, alternative asset class.

Isn’t crypto an amateur “sport?”

For most of its short history, cryptocurrency has been an amateur “sport.”Digital currencies, the best-known of which is Bitcoin, have had a turbulent upbringing. There have been fortunes made and lost as the market for crypto has seesawed dramatically. Cryptocurrency exchanges have collapsed or disappeared in spectacular frauds. But now the grownups have come to the table: Cryptocurrency trading has moved from the amateur to the professional arena. No bigger and more professional player has entered the fray than the world’s largest investor, Blackrock. Its recent and successful launch of cryptocurrency exchange-traded funds has created a new, alternative asset class.

What is Blackrock’s crypto history?

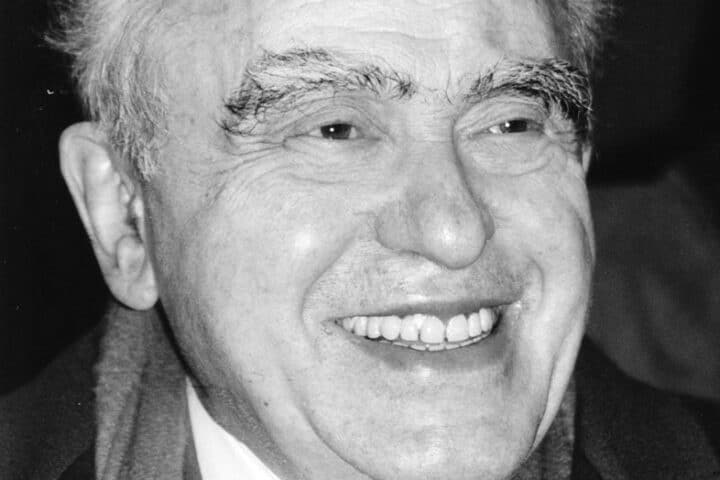

Blackrock’s size and influence in the crypto space have earned it the epithet “crypto whale.”This title is reserved for those who hold such large sums of cryptocurrency that they can potentially influence the market. BlackRock’s debut cryptocurrency ETF, the iShares Bitcoin Trust, has raised nearly $18 billion since it was launched on the NASDAQ exchange in January. However, there were not always enthusiasm and commitment to digital currencies. Larry Fink, the CEO of BlackRock went from being “a big believer” in cryptocurrencies in 2017 to calling them “an index of money laundering,” a few days later and comparing the crypto market to the Dutch tulip mania in the 1600s. But by 2022, Blackrock had become an investor in cryptocurrencies.

“There have been fortunes made and lost as the market for crypto has seesawed dramatically”

But why is BlackRock backing cryptocurrencies?

Amongst Larry Fink’s pronouncements on digital currencies has been that Bitcoin could render the dollar less relevant. The professional consensus began to recognize the promise of cryptocurrencies. On the one hand, they could visualize the blockchain technology behind these digital assets as transforming the international payments system. On the other hand, the innovation, diversification, and potential returns suggested cryptocurrencies as an alternative investment class. Cryptocurrency investment vehicles like iShares Bitcoin Trust, launched by Blackrock, could spearhead and consolidate numerous benefits to cryptocurrency investors. Such funds can lower the barriers to investing in cryptocurrencies: They will lower the transactions costs, reduce regulatory hurdles, and the high fees. But most important, such funds will increase the acceptability, liquidity, and hence the accessibility of cryptocurrencies to a wider and conventional market of investors.