The “AI Supercycle” is likened to the Klondike. The profitable opportunities in that gold rush resided not in finding the gold but in selling picks and shovels to extract it. Today’s pay dirt is not the user-facing applications like Chat-GPT but the computer chips driving AI. However, global tensions threaten the semiconductor supply chains.

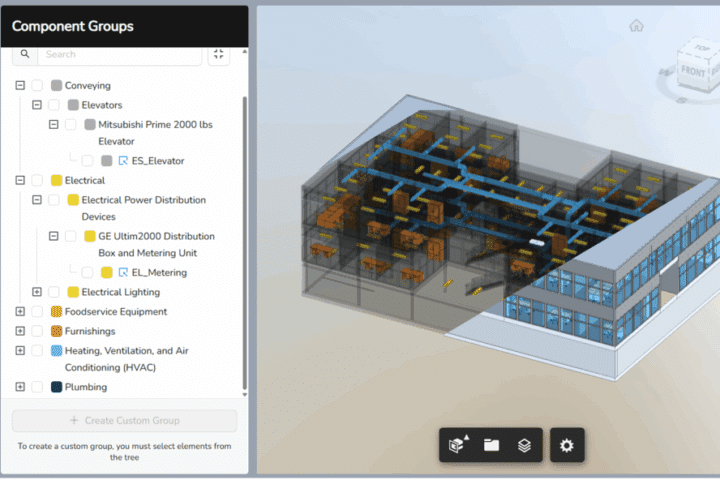

What are the components of the semiconductor ecosystem?

The venture capital firm, Andreessen Horowitz, characterizes AI as a stack. At the top are the user interfaces like the AI application Chat-GPT. In the middle are the large language models like GPT-4. At the base of the stack is the computer hardware relying on microchips of ever-increasing power. The makers of the “forges” for picks and shovels are firms like ASML. ASML claims “to give the world’s leading chipmakers the power to mass produce patterns on silicon”. Firms like Taiwan Semiconductor (TSMC) use ASML equipment to make the “picks and shovels” – the semiconductors. They are the foundries that produce the chips to the design specifications of NVIDIA and AMD, who focus on advanced chip architecture.

EUV lithography etching machines manufactured by Dutch world leader ASML

What role do Integrated Device Manufacturers play in the tech landscape?

Integrated Device Manufacturers (IDMs), such as Intel and Samsung, deal with both conception and architecture. Much of the work IDMs do, relies on their in-house capabilities. Their comprehensive control over the production cycle offers a significant buffer against disruptions. They may not always be at the cutting edge of nanometer technology, such as TSMC’s advanced 3nm processes, which is comparable to the diameter of a DNA branch. However, this autonomy is particularly valuable compared with the fragility of relying on external manufacturers. For example, TSMC’s foundry sits on the seismic fault line of tension between Taiwan and China.

“In a world fueled by AI advancements, being at the forefront of semiconductor innovation is not just an option; it’s essential.”

What are the geopolitical pressures and supply chain vulnerabilities in the semiconductor industry?

The ever-present threat of China’s looming claim to Taiwan threatens TSMC and other foundries’ global semiconductor supply chains. ASML too finds itself at the geopolitical crossroads. The company stands out with its exclusive technology for extreme ultraviolet (EUV) lithography, essential for producing the most advanced machinery used by foundries. However, the United States is pushing for restrictions on EUV technology exports to China. ASML’s role is pivotal not only in technological advancement but also in the geopolitical chess game that determines access to cutting-edge capabilities. These tensions reveal the broader industry, including giants like Samsung, must adeptly manage complex global supply chains vulnerable to political disputes and logistical disruptions. The interruptions of the semiconductor supply chain during the Covid pandemic illustrated global dependence on the tools required to feed the AI supercycle.